Financial Report is a statement that discloses an organization’s financial state to the management, investors, and the government. Odoo ERP is self-reliant in generating financial reports in the real-time. The basic accounting reports to advanced management reports are also provided in Odoo.

In Odoo community edition, pdf format is used for viewing various reports, but under the enterprise version, it supports both pdf & xls reports. The enterprise version also supports the drill down in reports.

Some of the reports provided by Odoo are :

1. Journal Audit

2. Partner Ledger

3. General Ledger

4. Trial Balance

5. Balance Sheet

6. Profit & Loss

7. Cash Flow Statement

8. Executive Summary

9. Aged Partner Balance

10. Tax Report

Under Odoo Enterprise Edition, one can configure the balance sheet, profit and loss report, cash flow statement & executive summary. But under the community edition, one can only configure, the balance sheet and profit and loss reports. However, new reports can be made in both editions.

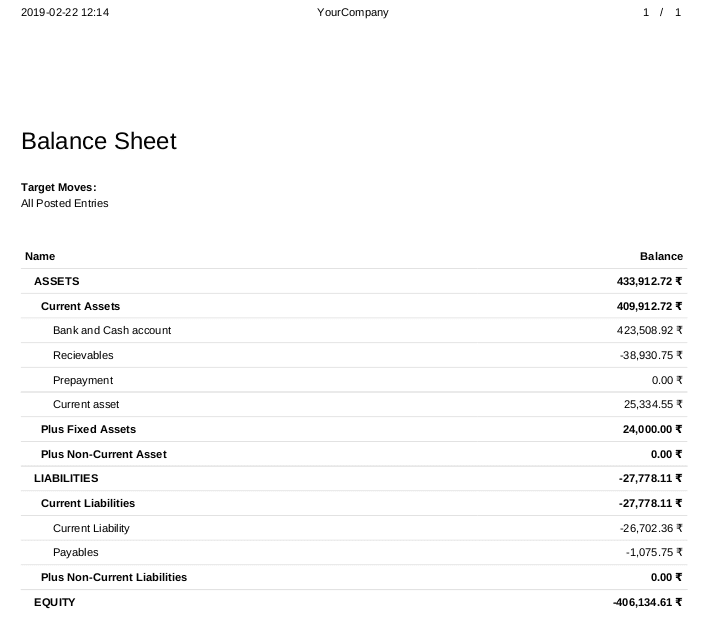

Balance Sheet Report

A balance sheet shows the asset, liability & equity of a business organization.

Profit and loss report

The profit and loss report is a report that shows the income and expense of a company during a particular period of time.

Cash Flow Statement

It is a budget summary that demonstrates how the adjustments in monetary record and salary influence the money and money counterparts. It likewise breaks the examination to operating, investing and budgetary exercises.

Executive Summary

Executive summary summarizes the profit & loss, cash flow & balance sheet reports.

Report Configuration in Odoo 11 Community Edition

Under Community Edition, one can configure the balance sheet and profit & loss report. The stock balance sheet and profit and loss report only show the basic details. However, If necessary a new report can also be generated.

Need for Configuration

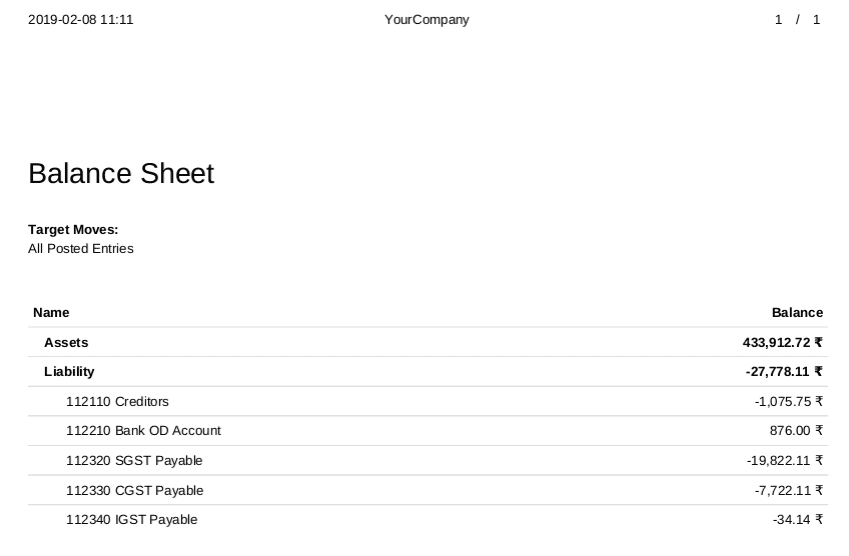

To understand the need for configuration, let us see a balance sheet report before configuring it.

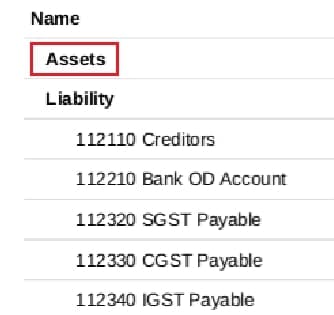

Here, we can see that the balance sheet report shows only the asset, liability and some accounts under liability. There is no information regarding how one have calculated the assets or the liability. As mentioned before a financial report is used to disclose an organization’s financial state to the management, investors and the government.

But the above balance sheet report does not show the necessary details. So to make the report more understandable, one needs to configure the report.

To add each line to a report, one can use the account reports.

Let’s see more about account reports.

Account Reports

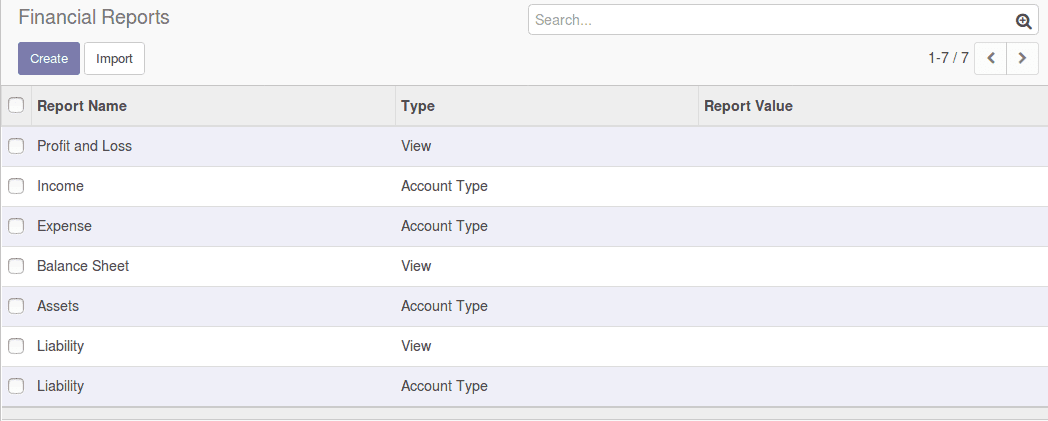

In order to add each line to a report, firstly one should create a new account report. To view, account report go to

Invoicing -> Configuration -> Financial Report -> Account Reports

To create a new account report, click on the create button

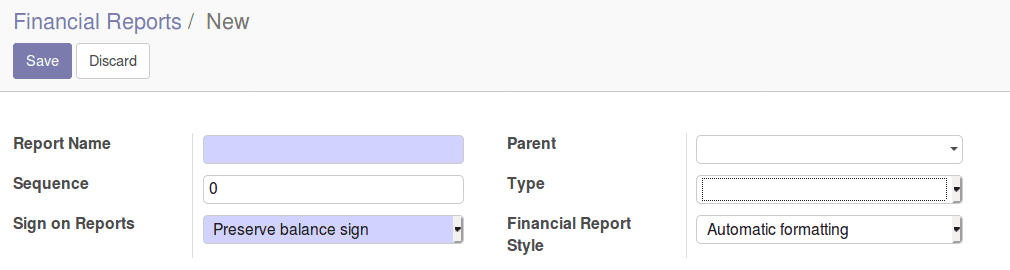

Report Name: Name of the report.

Parent: In which report do we wish to see the report that’s been created.

Sequence: Where on parent report we wish to see the new report.

Financial Report Styles: Reports format style can be set up here.

Sign on Reports

I. Preserve Balance Sign

For accounts that are typically more credited than debited and for accounts that we would like to print as positive amount in the report, we shall use this option.

Eg. Income Account.

II. Reverse Balance sign

For accounts that are typically more debited than credited and for accounts that we would like to print as negative in the report, we shall use this option.

Eg. Expense Account.

Types

Types are classified into four.

I. View

The report would be shown in the parent report.

II. Accounts

Accounts selected can be linked to the parent report.

III. Account Types

Account types selected can be added to parent report.

IV. Report value

To get the net value of a report.

Balance sheet report configuration

By configuring balance sheet report, we are going to add more details to the balance sheet report. In a balance sheet report, the main details that we need are assets, liability & equity.

Assets

The screenshot shows only the total asset value in the balance sheet. As you see they do not mention anything about current assets, fixed assets or non-current assets.

The current assets also include prepayment, receivables and bank & cash account.

So one need to add all these details to their report.

One has to add all these report lines for the assets. This is how the asset part has to look like.

Assets

Current assets

Bank & Cash account

Receivables

Prepayment

Current Asset

Plus Fixed Assets

Plus Non Current Assets

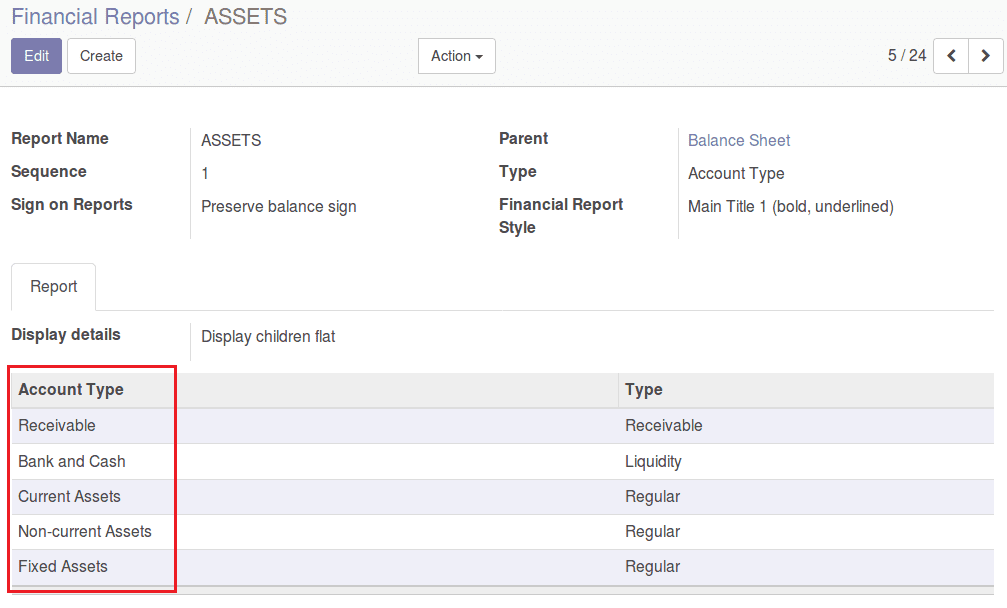

Account Report for Assets

Report Name: Asset

Parent: Balance Sheet

Sequence: 1

View: Account Types

Add all the necessary account types to calculate the asset.

Now under assets, one needs current assets, fixed assets & non-current assets. So while creating account reports for current assets, fixed assets & non-current assets, one need to give parent value as an asset.

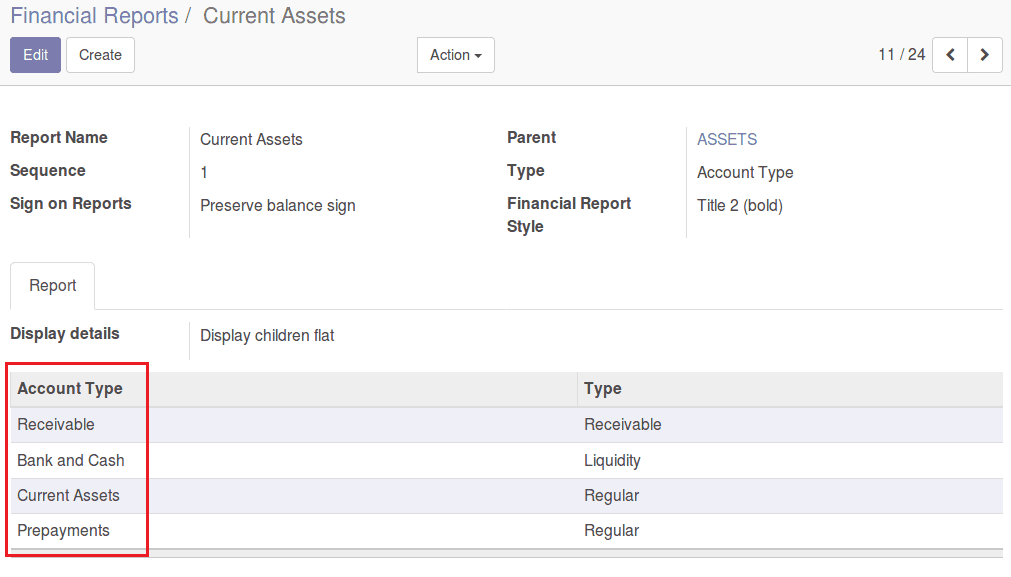

Account Report for Current Asset

Report Name: Current Asset

Parent: Asset

Sequence: 1

View: Account Types

Add all the necessary account types to calculate the current asset. The sequence is given 1 to list the current asset as first under the asset.

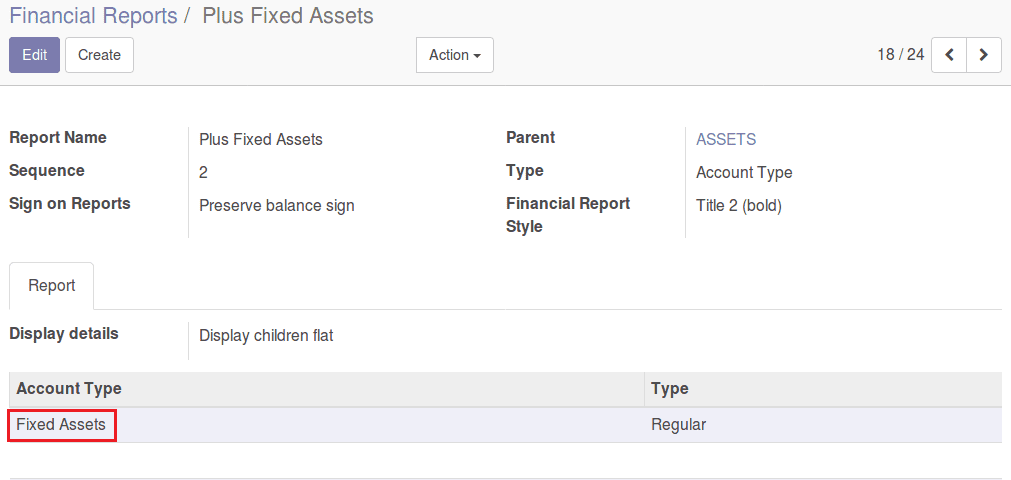

Account Report for Fixed Asset

Report Name: Plus Fixed Asset

Parent: Asset

Sequence: 2

View: Account Types

Add all the necessary account types to calculate the fixed asset.

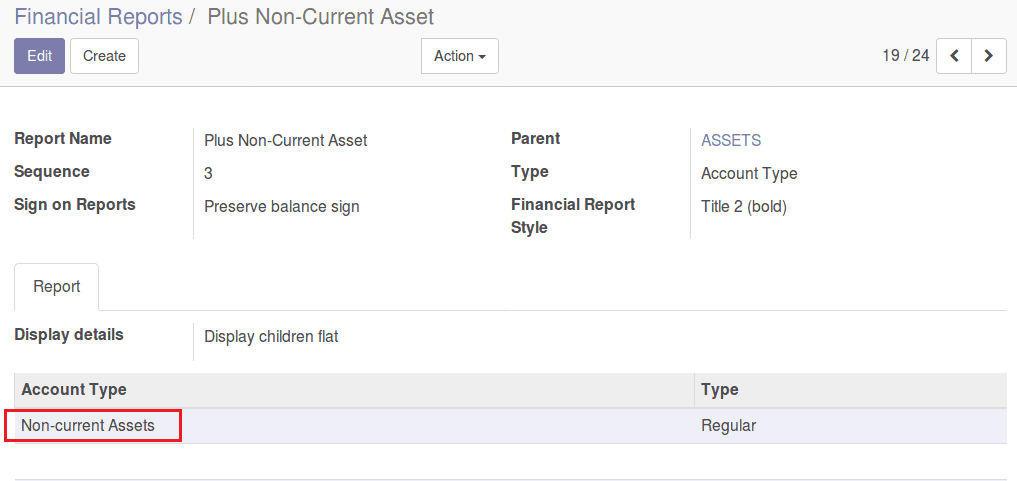

Account Reports For Non-Current Asset

Report Name: Plus Non-Current Asset

Parent: Asset

Sequence: 3

View: Account Types

Add all the necessary account types to calculate the non-current asset.

Under current assets, one needs to create the account reports for the current asset, bank, and cash, prepayment & receivable.

So while creating the account reports, keep the parent value as current assets for the current asset, bank, and cash, prepayment & receivable.

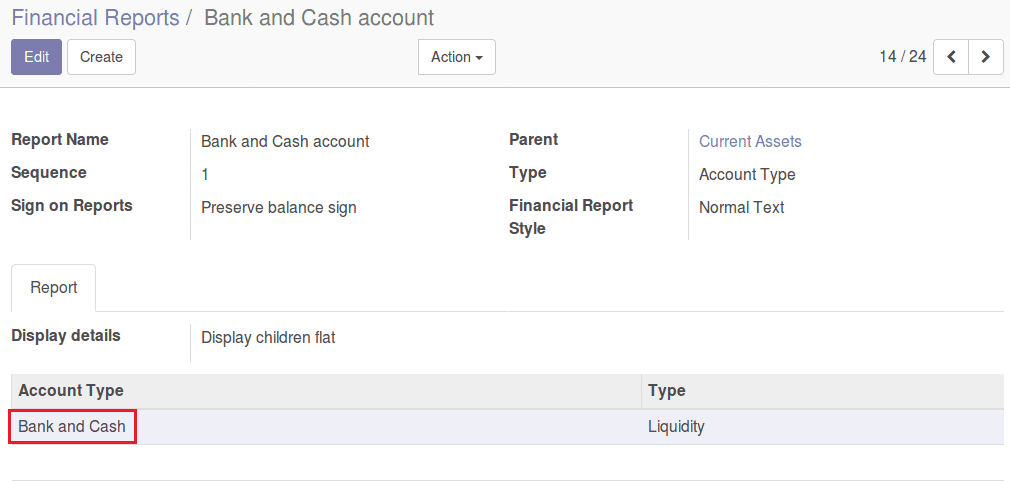

Account Reports For Bank & Cash Account

Report Name: Bank & Cash Account

Parent: Current Asset

Sequence: 1

View: Account Types

Add all the necessary account types for bank & cash account.

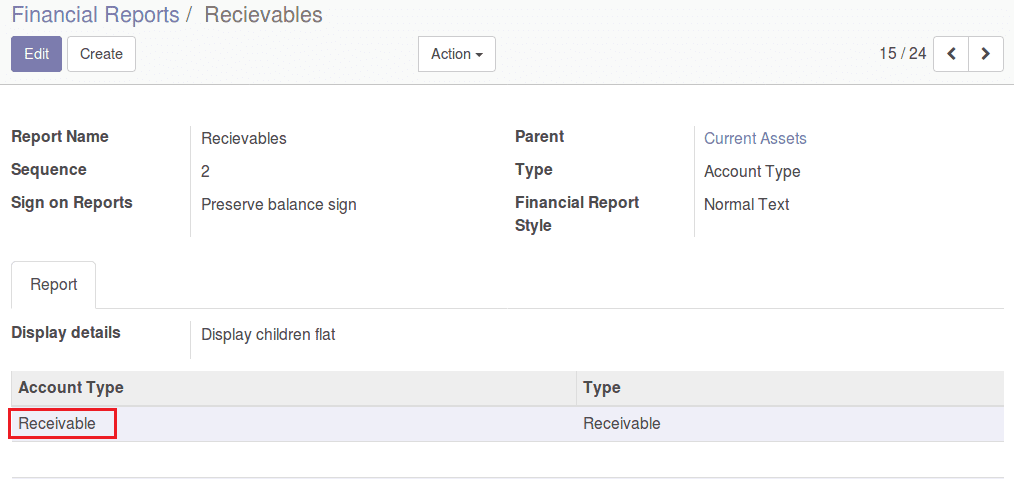

Account Reports For Recievables

Report Name: Receivables

Parent: Current Asset

Sequence: 2

View: Account Types

Add all the necessary account types for receivables.

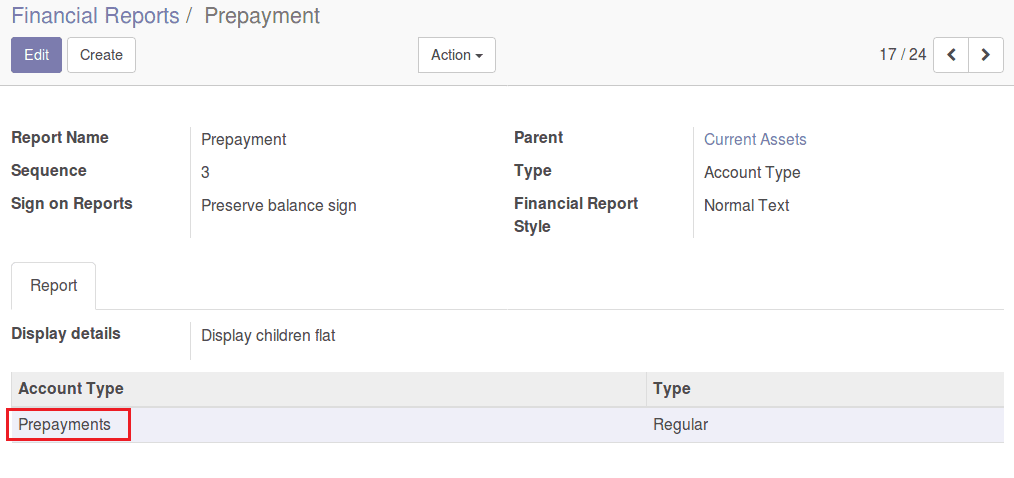

Account Reports For Prepayment

Report Name: Prepayment

Parent: Current Asset

Sequence: 3

View: Account Types

Add all the necessary account types for prepayment.

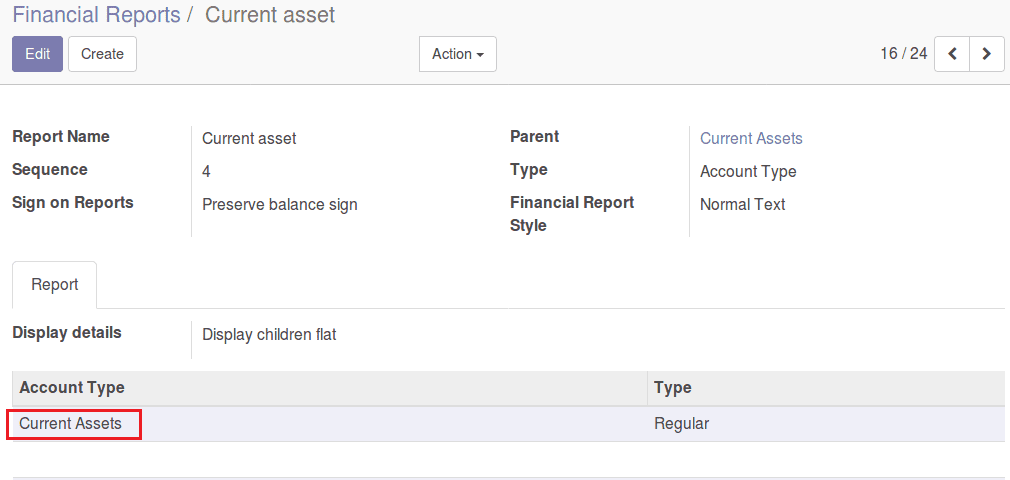

Account Report for Current asset

Report Name: Current asset

Parent: Current Asset

Sequence: 4

View: Account Types

Add all the necessary account types for current assets.

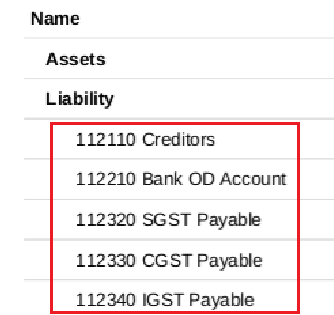

Liabilities

In the liability part of the balance sheet report, one can only see some accounts. Liability part of the balance sheet should have current liabilities and noncurrent Liabilities. A current liability is calculated by adding current liability & payables account. So they should also be mentioned in the liability part of the balance sheet.

This is how the liability part should look like.

Liabilities

Current Liabilities

Current liabilities

Payables

Non-Current Liabilities

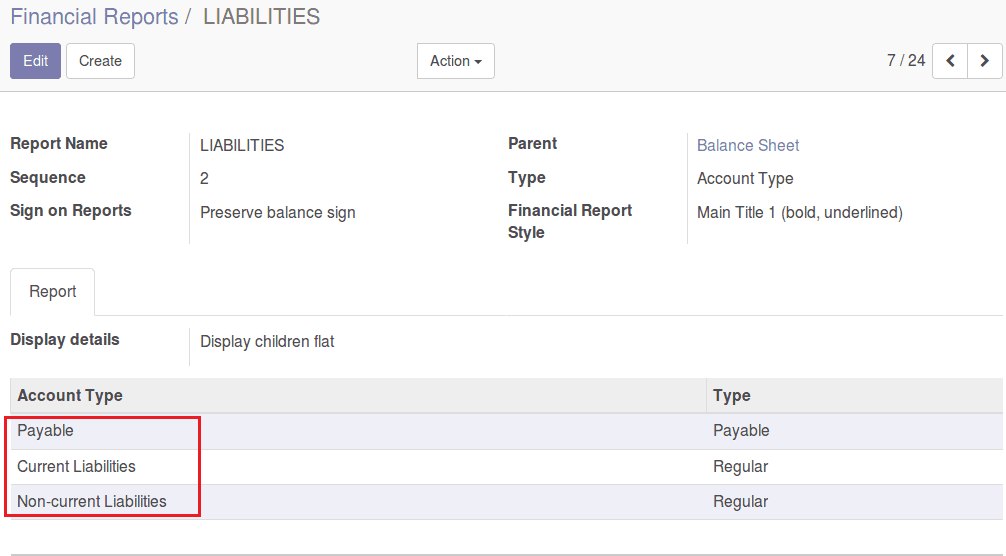

Account Report for Liabilities

Report Name: Liabilities

Parent: Balance Sheet

Sequence: 2

View: Account Types

Add all the necessary account types for liabilities.

Create account reports for current liabilities and non-current liability. As we need those reports to be under liabilities, the parent field should be set as liabilities.

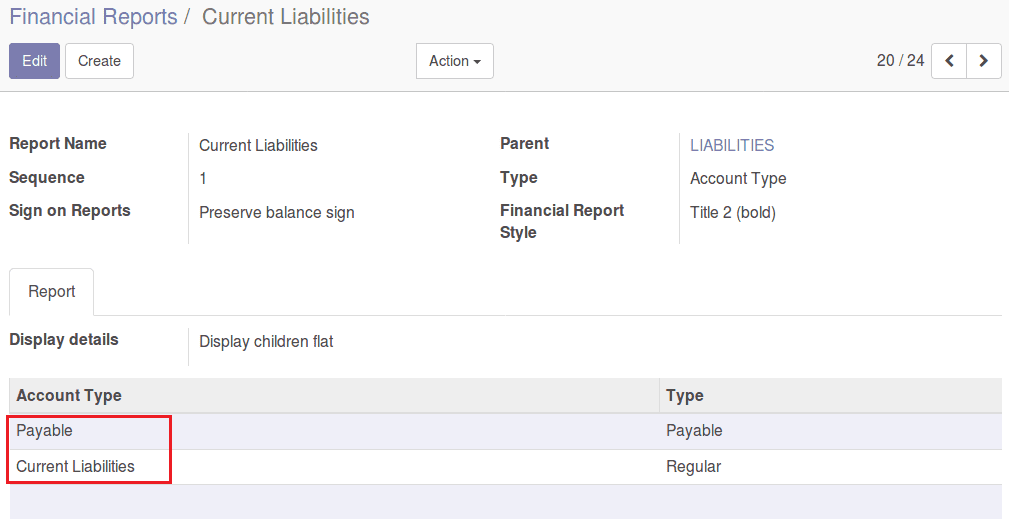

Account Report for Current Liabilities

Report Name: Current Liabilities

Parent: Liabilities

Sequence: 1

View: Account Types

Add all the necessary account types for current liabilities.

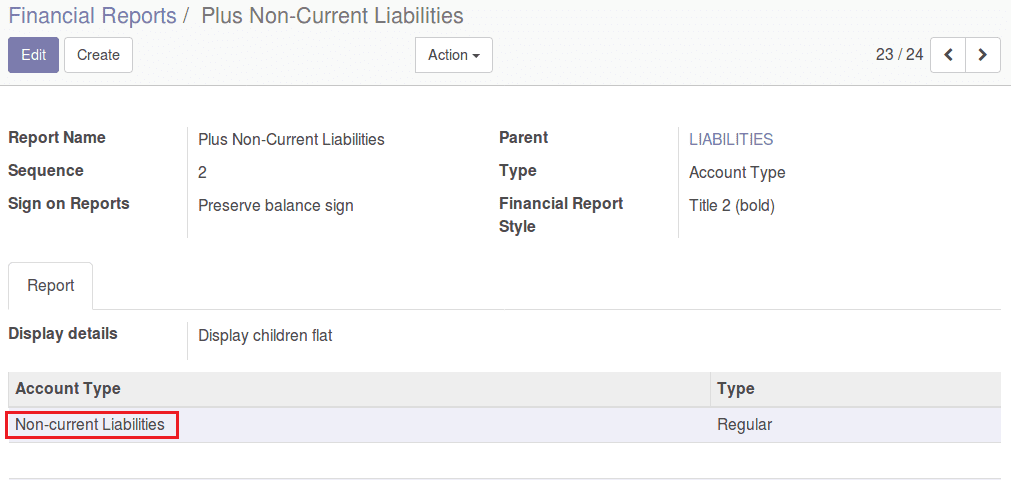

Account Report for Non Current Liabilities

Report Name: Non Current Liabilities

Parent: Liabilities

Sequence: 2

View: Account Types

Add all the necessary account types for non-current liabilities.

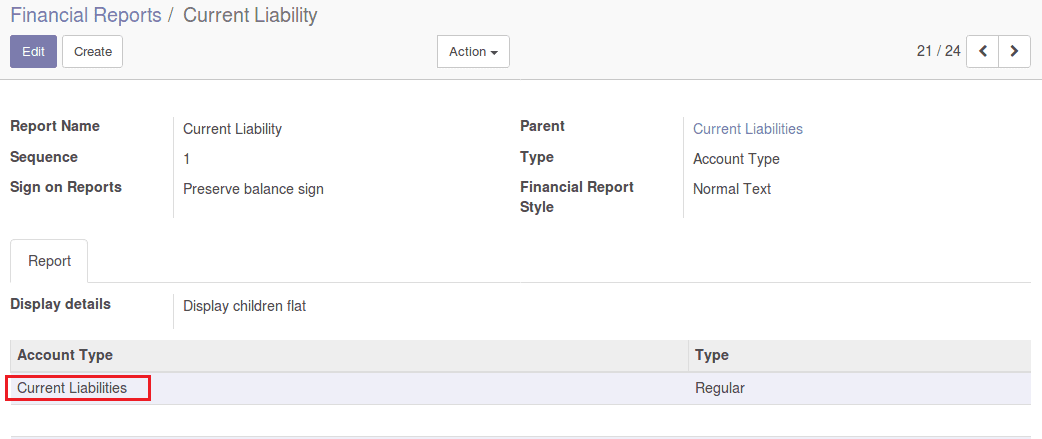

Account Report for Current liability

Report Name: Current liability

Parent: Current Liabilities

Sequence: 1

View: Account Types

Add all the necessary account types for current liability.

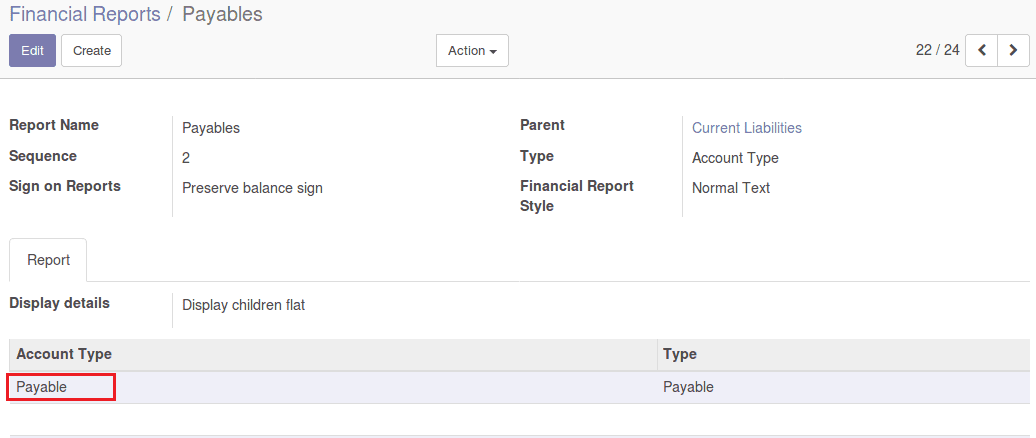

Account Report for Payables

Report Name: Payables

Parent: Current Liabilities

Sequence: 2

View: Account Types

Add all the necessary account types for payables.

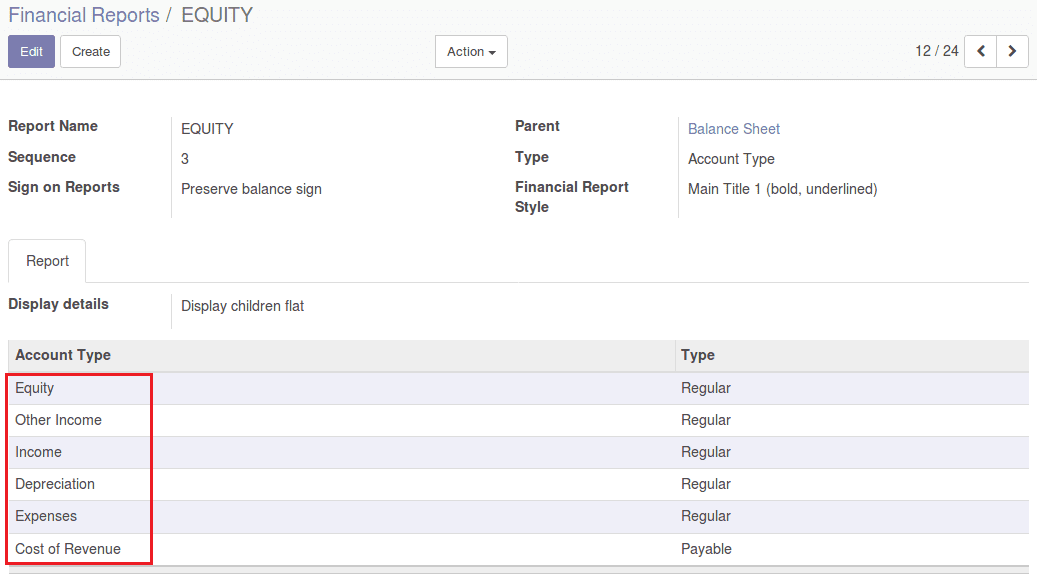

Equity

If we check the above balance sheet screenshot, one can see that there is no reporting line for equity. So to create a report line let’s make an account report for equity.

Account Report For Equity

Report Name: Equity

Parent: Balance Sheet

Sequence: 3

View: Account Types

Add all the necessary account types for equity.

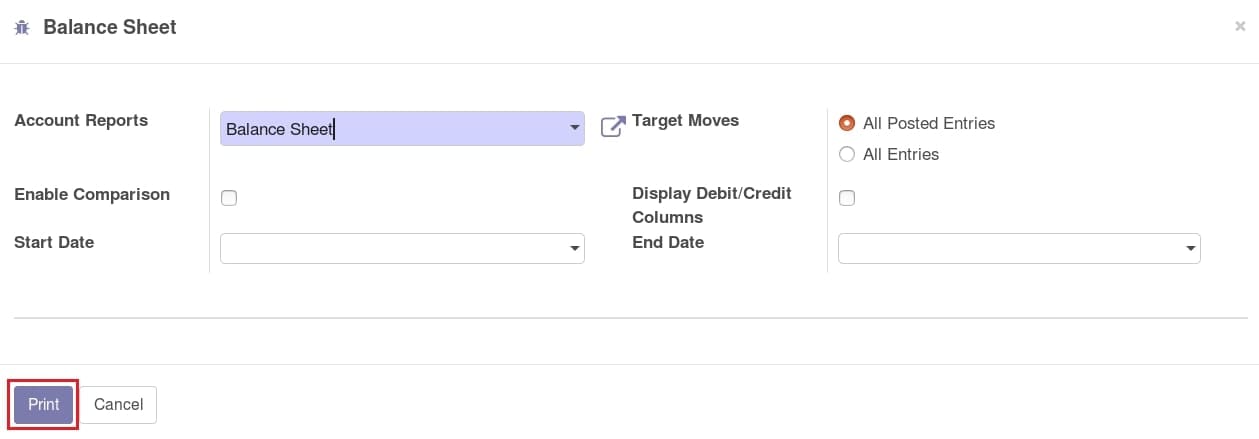

After creating all the account reports necessary for the balance sheet, now go to

Invoicing -> Reporting -> PDF report -> Balance sheet

On clicking the print button, the balance sheet would be printed.

Source: Financial Report Configuration in Odoo Accounting